The digital asset market is still largely misunderstood.

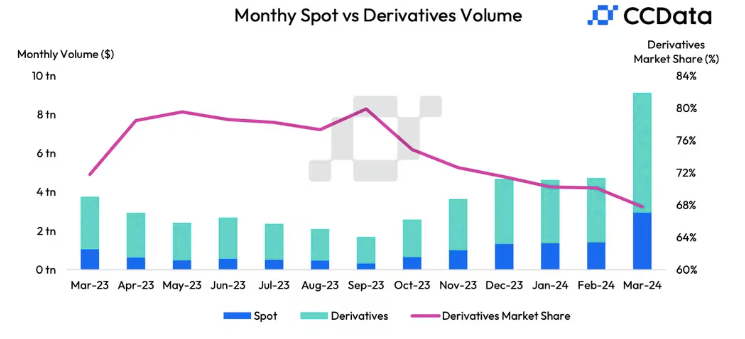

Perhaps no part more so than digital asset derivatives, despite making up 68% of all digital asset trading globally.

We’re shining a spotlight on digital asset derivatives, showing how and why they dominate trading, and one exchange striving to bring transparency to the space.

What in the World Are Digital Asset Derivatives?

Its only been about 15 years since the first digital asset was released as open-source software in 2009.

Coincidentally, this is around the same time the world’s first pirate stock exchange opened in Somalia.

Both are free market innovations, but one has become infinitely larger than the other.

The digital asset market is now worth a staggering $2.1 Trillion, with more than 40 individual digital tokens valued at over $1 billion, and a big reason why is digital asset derivatives.

A digital asset derivative is simply a financial contract between two or more parties that derives its value from the price of an underlying asset, say Bitcoin, Ethereum, or the like.

There are two common types of derivatives:

- Futures, which obligate parties to buy or sell an asset at an agreed upon price on a future date.

- Options, which give parties the right, but not the obligation, to buy or sell an asset at an agreed upon price on a future date.

When it comes to digital assets one dominates the landscape – futures, but not the traditional kind described above.

Rather, something called a perpetual futures contract, which makes up the overwhelming majority of digital asset trading volume.

Perpetual futures or perp futures are identical to their non-perp brethren, with one significant difference.

True to their name, perp futures have no expiration date and primarily trade on centralized offshore exchanges, on which nearly 99% of futures and options trading volume occurs.

They are an easily accessible, deregulated way to speculate on digital asset prices indefinitely, so its easy to see why they have been embraced by investors and speculators alike.

However, there is also another reason why perp futures and digital asset derivatives in general have become so popular – leverage.

Up to 100x

This is the maximum leverage limit offered on most centralized exchanges today.

Meaning $100 can get you instant access to $10,000 in trading capital.

This has the effect of pumping liquidity into the market, a good thing for creating a highly functioning, efficient market, but not such a good thing in that it makes the market inherently more volatile.

As a prime example of such volatility, more than $1 billion in leveraged positions were liquidated within the first 24 hours of the recent general market sell off, wiping out 300,000 investors in the process, which amplified the intraday losses of many digital assets.

Another reason the digital asset derivatives market has gotten so big, is because derivatives contracts are also used as position hedges.

Given that more institutional investors than ever before now own digital assets, minimizing changes in the value of their open positions is paramount and futures along with a more overlooked digital asset derivative, options, are an effective way to do it.

The Digital Asset Industry’s Only Monopoly

Despite digital asset exchanges rolling out option contracts on popular tokens, 80% of digital asset options trading still flows through one centralized offshore derivatives exchange.

Panama-based Deribit has long been the options trading leader in a space known for its fragmentation.

Inherent complexity, the need for liquidity, and primarily institutional trading of digital asset options has led to this outcome.

By some accounts, more than 30% of all digital asset options trading volume comes from institutional investors, who also deal in exotic derivatives.

Some of these include alternatives to perp futures such as perpetual options, which don’t expire and don’t have any restrictions on when they can be exercised.

Other similar derivatives include power perpetuals, which provide leveraged options-like exposure without the need for either strikes or expiries, but they have yet to produce meaningful volume.

Nonetheless, realizing that options are a monopolized, underserved area of the digital asset market, one exchange has set out to change this.

A New Frontier

Accessible, secure, and fast.

These are the core pillars that PowerTrade has built its exchange on.

Prior to founding PowerTrade in 2020, Mario Gomez Lozada helped start another exchange in 2014 – Liquid.

During his time as CEO, Liquid grew into one of the largest crypto-to-fiat exchanges in the world with daily volume of over $70 million and a large customer base in Japan, where it was based.

This led to its acquisition by the now infamous FTX in March 2022.

Now, Mario is determined to turn PowerTrade into the most complete digital asset options exchange in the world.

He’s off to a good start.

The exchange has maintained no minimum order sizes since its launch, making it more accessible to individual investors who want to get started with digital asset derivatives.

It has also adopted another tool commonly found on most popular trading apps – trade ideas.

This saves traders time by helping them discover market opportunities and collaborate with others. An essential feature that has been proven to fuel growth.

Paradoxically, PowerTrade is also robust enough to cater to the needs of institutional investors, who currently make up the majority of the digital asset derivatives market.

In 2022, the exchange rolled out a Request-for-Quote (RFP) system, which enables instant two-way quotes on all listed derivates and is a common feature on traditional options and futures exchanges, but not so common in the digital asset derivative space, until now.

This feature allows institutions to obtain the best possible prices for trades and is no doubt a key factor in helping PowerTrade eclipse $300 million in monthly trading volume.

PowerTrade has also partnered with renowned derivatives platform BitMEX to fuse infrastructure and technology, including providing its users access to BitMEX’s existing wallet system.

The partnership also promises trading in new financial instruments on the BitMEX platform, including BTC, ETH, DOGE, and XRP options and spot trading using PowerTrade’s RFP system.

By focusing on solving the problems keeping digital asset derivatives from being adopted by traditional finance clients, PowerTrade is expanding the market by bringing it directly to investors, wherever they may be.

At the moment, the digital asset derivatives market has two things going for it:

- Technological advancements

- Institutional adoption

In regards to the first point, blockchain technology is becoming increasingly more sophisticated by the day.

This includes better smart contract functionality, which can automate the execution of derivatives contracts, reducing counterparty risk.

Such advancements directly tie in to the second point – institutional adoption.

The more functional that the blockchain becomes, the more integrated into the global financial system it will be, leaving institutions with little choice but to adopt it or get left behind, in similar fashion to desktop and cloud software.

There is just one thing holding institutional investors back at this point.

As soon as digital asset regulation becomes more standardized, for which a legal framework has already been passed, it will be the third and final catalyst for digital assets and it’s derivatives.

If you found this article insightful, you may also like The Tokenization of Real World Assets or Charting New Territory: How DePIN is Changing The Physical World With Digital Technology

If you would like more information on our thesis surrounding digital asset derivatives or other transformative technologies, please email info@cadenza.vc

One response to “Beyond Bitcoin: How Derivatives Shape the Digital Asset Market”

[…] comes as no surprise. We were talking about how derivatives were shaping the digital token market last year, and saying that a more friendly regulatory regime would be the catalyst for digital […]

LikeLike