Bringing blockchain to the people.

This is Solana’s big claim, but how exactly does its blockchain platform differ from all the others?

Bitcoin is the largest digital asset by market cap, while Ethereum dominates Web3.

But Solana could have the most profound and far-reaching impact of them all and its about to become more accessible than ever.

What does this mean for the digital asset market and investors?

A New Architecture For A High Performance Blockchain

Decentralized blockchain technology is the safest and most secure way to not only use the internet, but store data, and Solana has optimized its platform for the two things most blockchain users have long been asking and waiting for…

Scale and speed.

Solana’s principal founder, Anatoly Yakovenko, believes that in order to get the public using blockchain technology, “the technology needs to be as easy and painless as possible to use.”

With this in mind and his background in helping build cell phone networks, Anatoly, along with some help from co-founder Raj Gokal, began to conceptualize a scalable and efficient platform that is able to transmit the maximum amount of information, while using the least amount of resources.

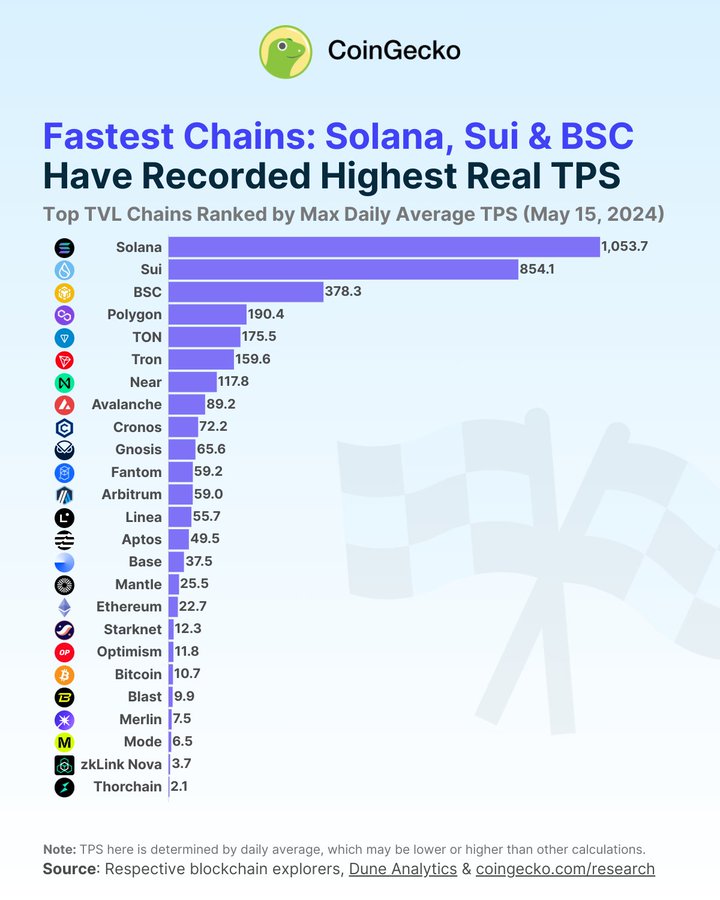

It took a few years since its founding in 2018, but what Anatoly and Raj managed to build is an original, open-source blockchain that is objectively the fastest in the world.

They accomplished this via one “special innovation.”

Proof of History

The core technical innovation behind Solana, dubbed Proof of History, is able to validate information faster than any other blockchain.

It does this by building a virtual timestamp into its own blockchain through a mechanism called a verifiable delay function (VDF) rather than relying on outside programs to assign such a timestamp.

Think of it like taking a direct flight to your destination instead of one with multiple stops and layovers.

What’s more, because the blockchain can be verified by a small piece of info, more than one part can be verified at any given time, whereas most programmable blockchains can only validate a single blockchain at a time.

However, the real kicker is that not only is Solana the fastest blockchain, capable of processing 1,504 daily average transactions per second (TPS).

But, due to its self-validating Proof of History, it is also cheaper than most other blockchain networks.

These two things have enabled it to become the blockchain of choice for a growing number of real-world use cases.

Infrastructure for Everyone

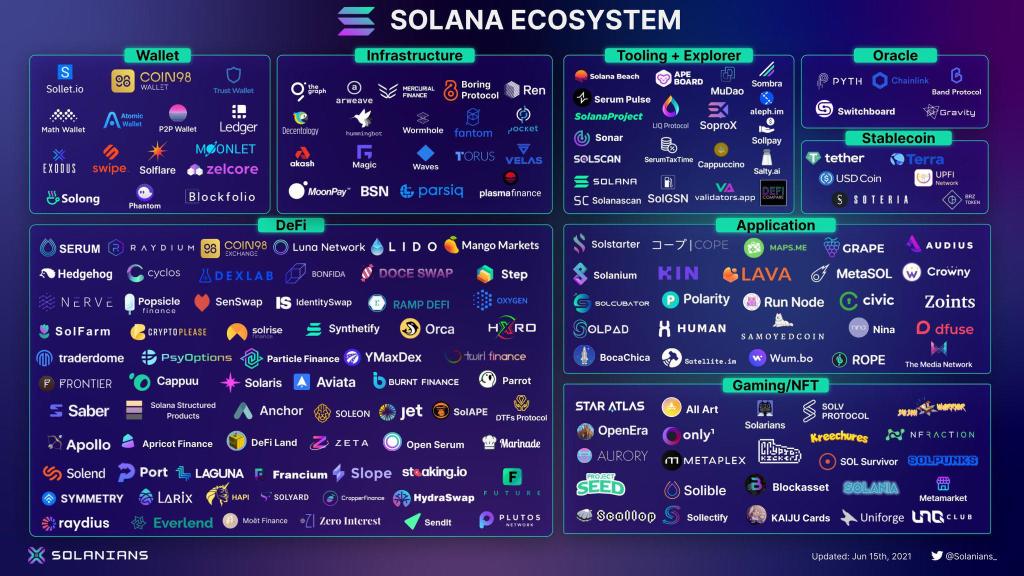

Everything from meme coins to ecommerce, and gaming applications have been built on the Solana blockchain network.

However, one of its most significant use cases to date has been real-time financial settlement.

Fast, cheap, scalable. These words are music to the ears of anyone who has ever had to conduct a financial transaction.

We have said it here before and we will say it again now – the legacy banking system is broken.

Given the computing power and fiber-optic networks that exist today, it shouldn’t take a simple money transfer multiple business days to settle, while also costing more than 1% in fees.

Solana is changing this.

Not only is near-instant settlement now possible, but it costs basically nothing or an average fee of 0.00025 dollars.

A growing number of financial institutions have recognized this and are adopting Solana.

Stripe’s Onramp

Its fitting that the financial infrastructure firm would choose Solana as its payment infrastructure partner.

For the first time since 2018, when Stripe stopped accepting Bitcoin due to its inherent volatility, business customers can now once again accept cryptocurrency payments, which will primarily be processed through the Solana network.

However, this could be just the beginning.

Given Solana’s proven network, its growing number of use cases, along with the trend of financial transactions beginning to be settled on-chain for safety and efficiency, SOL is looking like a backbone of the financial system of the future.

However, the blockchain network is also increasingly being used for a different kind of infrastructure.

Hivemapper’s People-Powered Map

The world is changing fast and so is the way physical infrastructure is built and maintained, including maps.

Cadenza-backed Hivemapper is building the world’s first people-powered, dencentralized map, and its doing so on the Solana network.

This means Hivemapper’s nearly 149,000 incentivized contributors, who have mapped more than 277 million kilometers of the earth’s surface, and growing by the minute, hour, and day, are supported by Solana’s scalable blockchain.

Since maps aren’t a static creation, but rather a dynamic, ever-evolving application, speed and reliability are mission-critical functions.

To date, Solana has efficiently managed Hivemapper’s demand for big data and underpinned its rapid growth.

As we’ve previously documented, Solana is already “under the hood” of a growing number of services and solutions, but its also about to be front and center for retailer investors.

A New Way To Access The World’s Fastest Blockchain

One of Solana’s well-known slogans is “made for mass adoption“, which could be about to happen, as it is now officially next in line to get a dedicated exchange traded fund (ETF).

This is a significant development for a couple of reasons.

According to VanEck CEO and Cadenza partner Jan van Eck, whose firm has already listed a Bitcoin ETF (CBOE: HODL), secured SEC approval for an Ethereum ETF in May, and is now hoping to get approval for the first ever Solana ETF. 90% of all Bitcoin ETF inflows to date have come from retail investors.

This has increased the amount of retail investors owning Bitcoin by double digits from a year ago.

Should this pattern hold in the case of Solana, it could mean the beginning of a large increase in retail investor adoption, pushing SOL into the third spot of most valuable digital assets, behind only BTC and ETH.

Second, a significant increase in Solana’s visibility could spur more projects to be built on its network, which already boasts well over 400 applications and counting.

As this pace quickens, its overall usefulness and intrinsic value will continue to grow, fulfilling its mission of “powering the world“.

On this note, expect Solana to continue to outperform other established digital assets, such as Bitcoin and Ethereum over the short/mid-term on the back of VanEck’s SOL ETF application.

However, as market enthusiasm inevitably tapers somewhat waiting for an SEC decision next year and its price wavers, you can hold SOL knowing that it’s true underlying value will continue exceeding its market value.

If you enjoyed this article, you may also like Digital Assets for Everyone: How ETFs are Taking the Blockchain Mainstream or Charting New Territory: How DePIN Is Changing The Physical World With Digital Technology

If you would like more information on our thesis surrounding Solana or other transformative technologies, please email info@cadenza.vc