Latin American economies have experienced everything from debt crises to bank runs, and dictatorships.

But now the region stands out for another reason – its adoption of digital assets and the financial freedom it is ushering in.

We look at the main reasons digital assets are being embraced, including some surprising ones and a few of the services paving the way for decentralized finance.

Not Just Trading And Speculation

Since becoming a reality in the early 2010s, the stated purpose of digital assets has been to act as money and an electronic payment system based on cryptographic proof, instead of one based on blind trust and faith, like the current fiat currency standard.

However, that is not what they are most commonly used for today.

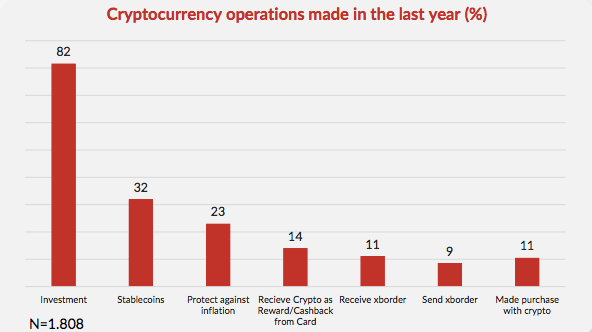

In the United States for example, digital assets are most often bought as an investment, rather than used as a means of exchange.

In Latin America (LatAm) regional differences abound, with digital assets holders in Peru being the heaviest Web3 gaming users, while nearly 40% of Colombian digital asset buyers prefer going through peer-to-peer channels rather than centralized exchanges.

However, all have one thing in common. Digital assets are predominantly purchased and used most for investment purposes.

But its second most common use stands out – Obtaining access to dollar-pegged digital currencies known as Stablecoins.

Safety And Stability

Stablecoins closely track the value of the asset they are pegged to, such as the U.S. Dollar, and thus are far more stable than most other digital assets.

By some accounts, USD stablecoins account for over 60% of all Latin American digital asset trades.

There are a few reasons for this.

The most prominent is the inherent instability of many LatAm economies, with mismanagement, corruption, and poverty being the norm, rather than the exception.

Against this backdrop, trust in traditional institutions is low, making such markets ripe for the adoption of digital assets.

Another major reason is the hidden tax of inflation.

In 2023, the average inflation rate across the region was officially 14.4%. Meaning that the actual figure was in all likelihood much higher, given that most official estimates often strip out “volatile” energy and food costs.

While it’s true that outlier countries such as Venezuela and Argentina helped push the official figure higher, double-digit annual inflation will quickly have anyone searching for a store of value.

This has taken the form of buying and holding stablecoins such as Tether (USDT), which is even more popular than Bitcoin across the region.

But besides investment and savings protection, there is another common use for digital asset that is unique to LatAm.

Real World Commerce

Nearly half of digital asset owners in LatAm have a debit card linked to their digital asset account.

This is closer to digital asset’s initial stated purpose of being used as money.

In fact, the most relevant use case for digital asset-denominated cards, is using them at retail or online stores, with over 10% of cardholders saying they regularly make purchases.

The rapid pace of digital asset adoption, which includes two countries (Venezuela and Brazil) ranking in the top ten globally, has even made the likes of Visa sit up and take notice.

The payment card issuer has partnered up with Fintech firms and digital asset exchange startups alike to help facilitate digital asset-to-fiat transfers and purchases anywhere Visa is accepted.

One of these partners is Cadenza-backed Lemon Cash.

The #1 Digital Asset App in LatAm

With more than 2.6 million users across the region, Lemon Cash is “the only digital asset app you need.”

This is an ode to the app’s multiple functions, starting with a full-fledged exchange.

Upon opening the app, you can deposit funds and instantly exchange pesos or whatever your local currency may be for Bitcoin, USDT, Ethereum, and more than 25 other digital assets for less than 0.50%.

Once funds have been deposited and are in the currency of your choice, commission-free international digital asset transfers are available to 7 Latin American countries.

But this basic functionality is just the start.

DeFi Profits

MakerDAO, Uniswap, Pancakeswap.

These are just a few of the top decentralized finance (DeFi) protocols that can be accessed with the Lemon Earn feature.

This matters because with Lemon Earn you can directly invest in the tokens of these protocols and generate weekly profits.

Simply put, DeFi protocols are blockchain-based platforms that are disrupting traditional financial services such as lending and trading, and rendering intermediary fees from banks and brokers relics of the past.

Since DeFi protocols are executed by code rather than any single entity, they are being embraced across the LatAm region with the number of Lemon Cash users investing in DeFi growing by double digits last year.

Yet another function that is being fully embraced is digital asset purchases.

An Essential Tool

We live in a world of choice overload.

From food delivery services to digital asset tokens, but Lemon is helping solve our paradox of choice by aggregating the ability to pay for more than 4,000 services directly from inside the Lemon app, using digital assets.

All we need is the Visa Lemon Card, which is free, prepaid, international, and we’re all set.

To date, it has proven to be a bridge between digital assets and traditional payment services, with 38% of Lemon app users using digital assets to pay for everyday services.

The digital assets most commonly used to pay for services to date have been USDT and Bitcoin, with the most paid for services being utilities, like telephone, internet, and electricity bills.

This has turned Lemon into an essential tool that users access several times per month. A rarity in this day and age, when the average smartphone user only uses 30 apps in any given month.

However, one of the biggest challenges that apps such as Lemon Cash are helping solve is the money remittance problem.

A Multi-Billion Dollar Opportunity

In 2023, $156 billion in remittances were sent across the LatAm region.

On this $156 billion, some $9.5 billion in commissions were paid, which amounts to a whopping 6%.

These fees stem from the fact that the money sent travels across multiple financial systems in various countries, with financial intermediaries taking a cut every step of the way.

Blockchain infrastructure and Lemon Cash have a solution to this.

Since the internet isn’t constrained by physical borders and digital asset transfers do not carry any arbitrary minimum or maximum amounts; they can be completed in seconds or minutes, even during periods of high congestion on blockchain networks, for one low cost.

This is fast becoming a reality as the value of an open and decentralized financial system, such as the kind Lemon Cash offers direct access to, is beginning to be appreciated by more and more people, not just in Latin America, but across the world.

The only things standing in the way of such unfeathered financial freedom are scalability and user experience, which are beginning to be addressed by apps such as Lemon Cash and a growing number of consumer-first DeFi services.

If you found this article insightful, you may also like Emerging Market Digital Assets – A Look At The Future or Digital Assets for Everyone: How ETFs are Taking the Blockchain Mainstream.

If you would like more information on our thesis surrounding DeFi or other transformative technologies, please email info@cadenza.vc

2 responses to “Digital Gold Rush: How Digital Assets Are Ushering In A New Era of Financial Freedom in Latin America”

[…] you found this insightful, you may also like Digital Gold Rush: How Digital Assets Are Ushering In A New Era of Financial Freedom in Latin Americ… or From Blocks to Billionaires: The Story of Bitcoin’s Expanding […]

LikeLike

[…] If you found this insightful, you will also like Guardians of the Digital Galaxy: How AI is Changing Cybersecurity and Digital Gold Rush: How Digital Assets Are Ushering In A New Era of Financial Freedom in Latin Americ…. […]

LikeLike