The biggest challenge small business owners face is a lack of capital.

Although technology has drastically changed how and where we use money, it has hardly changed our ability to access it.

This is what one startup is attempting to solve and redefine the future of small business finance in the process.

We’re revealing who they are and how they are doing it.

A Few Big Waves

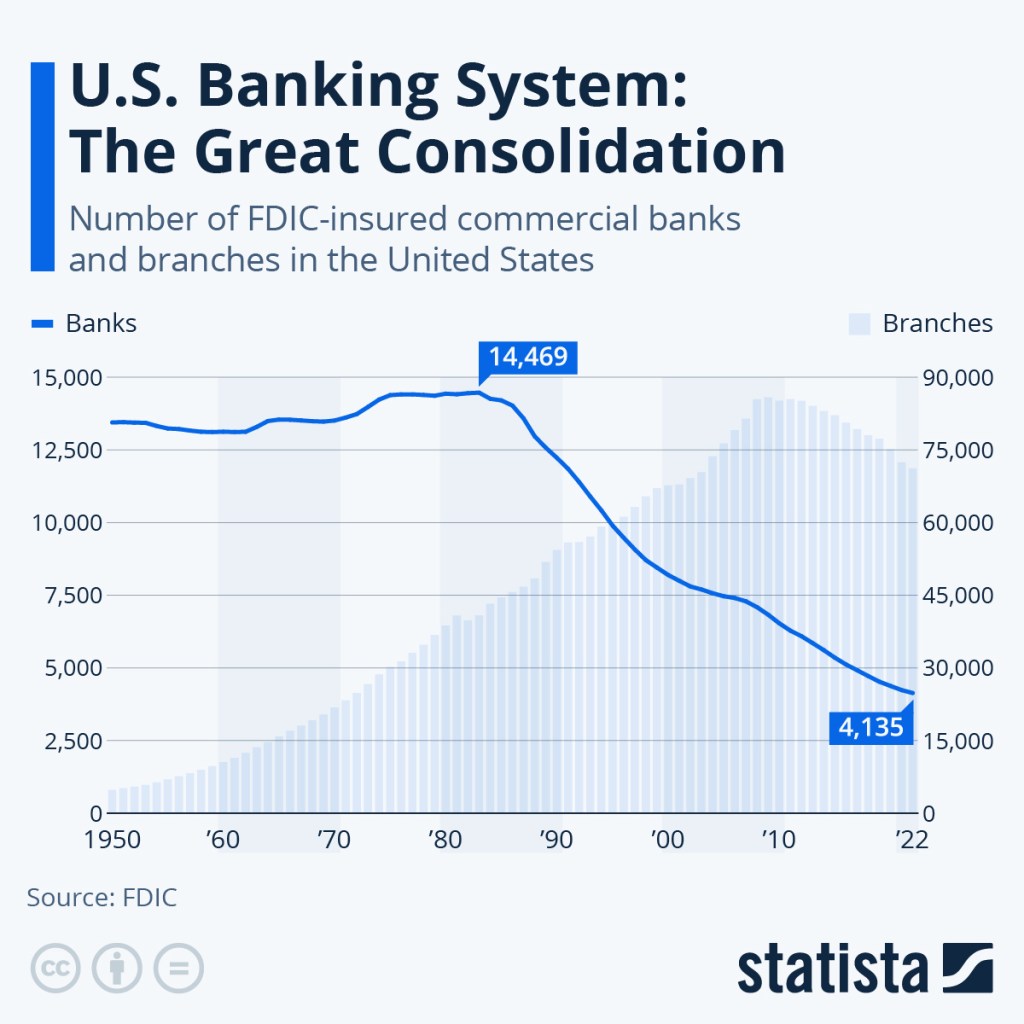

Over the past century, the number of US banks in operation has fallen by nearly 90%.

This “Great Consolidation” has come in a few big waves and has had lasting consequences on small business finance.

It all started with an event so catastrophic, that it caused more than 9,000 bank failures and millions to lose their life savings.

I’m talking about the Great Depression of the 1930s.

In the wake of such a shock to the financial system several safeguards were put in place, such as the Federal Deposit Insurance Corp. (FDIC) to backstop bank depositors from losing their savings.

This served its purpose, as no depositor has lost money since, but it did not prevent the next wave of bank failures.

During the Savings & Loan crisis of the 1980s, several thousand more financial institutions went under following a loosening of lending and investment standards.

Although the next wave of bank failures wouldn’t occur for another 20 years or so, the theme would be the same.

Only this time around, the fallout would be much worse.

A decided “relaxing” of mortgage lending standards initiated a “Great Recession” in which more than 500 national and regional banks went bust.

These periodic waves of crashes have consolidated the traditional lending market, bringing it to a point where more than three-quarters of small business owners say they are concerned about their ability to access capital.

The 65% Rule

Venture investors have long known about the 90% rule.

That is, 90% of startups, across all industries fail.

Well, when it comes to small businesses there’s a 65% rule.

According to the Small Business Administration (SBA), 65% of small businesses do not make it past the ten-year mark.

The reasons vary, from entrenched competition to ineffective sales strategies. However, one of the top reasons among all small business failures is insufficient capital to cover operational costs.

In a nation with nearly 4,500 lending institutions, this hardly seems plausible. So, what’s really going on?

Fewer Than 500

The first thing that stands out is the common definition of a small business.

A commonly used description is “a firm or enterprise with fewer than 500 employees“.

However, the reality is much different. 90% of small businesses have fewer than 20 workers.

So when The Fed stated in a previous report about availability of credit to small businesses, it mentioned that the flow of funding returned post-2020. It was talking about funding to firms under the common definition above and not the one rooted in reality.

It’s Personal

One of the most popular forms of small business credit is an SBA 7(a) loan.

Such loans are more likely to be underwritten because the SBA insures them. But there’s just one catch.

In order for a small business to qualify for an SBA-insured loan, it requires a personal guarantee from every owner with a 20% or greater equity stake in the business.

Even this may not be enough in some cases.

For example, any loan above $25,000 requires personal collateral to be put up. In most cases, this means a personal residence.

So, if you need more funding and don’t own your home, you may just be out of luck. Unless you go hat in hand to an alternative lender.

The Last Stop

Alternative lending comes in many forms, from invoice-advances to equipment-based financing.

However, it has one thing in common.

Alternative lenders know that you didn’t qualify for traditional bank-based financing and will use this to extract the most favorable terms possible.

These can include everything from onerous origination fees to interest rates that start at prime plus 2% and go well into the double digits.

Fortunately, technology has not only made the lending process more transparent than ever before, but it has also introduced brand new options for business borrowers.

Financing America’s Backbone

Helping small business owners solve their biggest challenges requires a deep understanding of what it is like to own and operate a business.

The co-founders of Affiniti, a full-suite financial platform, know what it is like all too well.

Prior to founding Affiniti, Aaron Bai and Sahil Phadnis helped small businesses automate their operations and sell their products online. During this time they realized there was a wide gap between the financial needs of small businesses and the solutions available.

Affiniti addresses this gap in the market by providing businesses with customized credit cards and a single dashboard from which to manage financial operations.

Its offering steps up where others fall short in several ways:

Tailor-Made

First, no one understands your business better than you do.

That’s why Affiniti partners with industry associations led by practitioners in their respective fields to offer cards loaded with features, rewards, and support tailor-made for each business.

This includes everyone from independent HVAC contractors to auto dealers.

Nothing Personal

Unlike traditional financial institutions and most alternative lenders, a business card obtained through Affiniti does not affect your personal credit.

But this is just where the perks begin.

Not only are there no origination fees, but businesses are eligible for a sign-up bonus depending on the first three months spend.

Another major difference is that an Affiniti-originated card has no annual or other fees.

From this perspective, Affiniti doesn’t just make financing more accessible, but also more cost-effective.

A Better Alternative

By focusing on solving the single biggest challenge for the largest, most underserved market in the country, Affiniti’s upside is nearly unlimited.

Although it’s still early days, the Affiniti financial dashboard is already used by small businesses generating $3B in combined annual revenue.

Investors, including Cadenza, have taken notice and backed Affiniti with $62 million in funding to help roll out its platform nationwide.

Considering the company’s average customer today employs 5 people and the largest state it serves is Mississippi. The funding will go a long way.

For all of the innovation and progress that Fintech has brought us, from faster, cheaper transactions to entire alternative currencies. It has yet to solve some of the most basic challenges for one of the largest segments in the country – small businesses.

Affiniti now has an opportunity to become the financial operating system of small businesses and become the most essential Fintech on Main Street.

If you found this insightful, you may also like Digital Gold Rush: How Digital Assets Are Ushering In A New Era of Financial Freedom in Latin America or From Blocks to Billionaires: The Story of Bitcoin’s Expanding Ecosystem.

If you would like more information on our thesis surrounding Fintech or other transformative technologies, please email info@cadenza.vc