Open-source, low fees, stability, and scalability.

These are just a few reasons why the Base ecosystem has become the fastest-growing platform for building decentralized applications (DApps) worldwide.

But what is it exactly and how is it helping bridge the gap between traditional and decentralized finance?

An Optimistic Rollup

This may sound like a bygone 1980s M&A strategy, but its actually the name of the protocol which makes the Base ecosystem possible.

The Ethereum blockchain, on which the Base ecosystem is built, has become the preferred platform for smart contracts due to both its security and decentralization.

However, the very two things that have made it into what it is today, have also compromised the popular blockchain.

See, processing more than one million transactions per day has congested the Ethereum blockchain, slowing it down, and increasing gas fees.

The solution is scaling the network, but how to do it without sacrificing safety and privacy?

This is where an Optimistic Rollup comes in.

To put it simply, Optimistic Rollups are a Layer 2 scaling solution for the Ethereum blockchain which allows transactions to quickly and securely be executed off-chain.

So named because they “Optimistically” move computation and data storage off-chain and “Rollup” transactions into batches before processing them, it is the motor that makes Base go.

Still, this underlying architecture isn’t the primary reason for the Base ecosystem’s rapid rise.

A Coinbase Creation

In the first half of 2023, Base was incubated by one of the most well-known digital asset exchanges in the world, Coinbase.

The mission statement in Coinbase’s Secret Master Plan document reads “create an open financial system that increases economic freedom globally.”

If building an exchange was the bridge for people to get their local currency into and out of digital currency, then an easily-accessible platform for DApps like Base is the vehicle that will get more consumers and businesses using them.

From this standpoint, it really has been building towards the Base ecosystem since the beginning.

Since launching in August 2023, with Coinbase facilitating its initial adoption of about 100 early developers, the Base ecosystem’s growth has been meteoric.

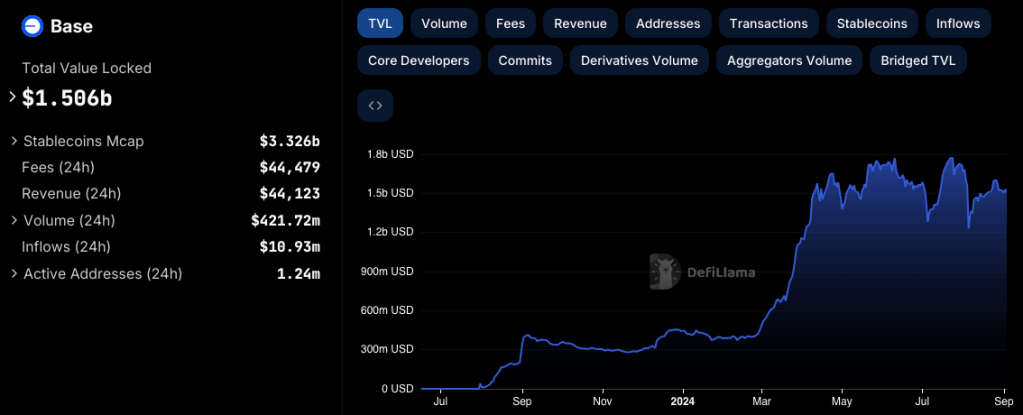

Over the past year, the platform has onboarded a massive 6 million active addresses across all decentralized apps, it handles an outrageous 3 million daily average transactions and counting, and has a whopping $1.5 billion in total value locked.

Another factor in its ascent has been the Base ecosystem fund.

Seeded by Coinbase’s venture arm, Coinbase Ventures, to the tune of several million dollars, and subsequently joined by several early investors, including Cadenza partner VanEck, the fund was established to invest in the next generation of onchain projects built on Base.

Base’s close integration with Coinbase combined with financially incentivized development, and the promise of faster transactions at lower fees has made it the place to create DApps.

Decentralized Innovation

As an example of Base’s widespread adoption, some tokens launched on the platform have lead to periods where its daily transaction volume has outpaced that of Ethereum itself.

Such speculative frenzy has its fair share of drawbacks, but it also breeds experimental innovation creating new forms of blockchain infrastructure technologies and decentralized exchanges that push the boundaries of what’s possible in DeFi.

One such exchange is Cadenza-backed BSX.

The premier high-speed perpetual futures exchange in the Base ecosystem, with more than 100,000 active users and over $4 billion in trading volume since launching in the first quarter of 2024.

We have previously touched on digital asset derivatives, so we will instead look at what makes BSX different from its contemporaries.

The Future of Derivatives Trading

First, unlike many new digital asset tokens and services launched by shadowy figures with murky pasts, BSX’s founding team all come from notable DeFi institutions such as Coinbase itself and several venture capital firms, including Kraken Ventures.

The combination of DeFi and traditional financial experience gives the exchange valuable insight to bring the two together.

Second, BSX is something called a decentralized exchange (DEX).

This means two things:

- It is a peer-to-peer exchange where transactions take place between traders

- The exchange does not take custody of trader funds

DeFi hacks are a real thing, with $1.4 billion lost in 2023.

Although this figure is down by about 50% compared to the prior year, it remains one of the top concerns for traders.

One has to look no further than high-profile implosions of centralized exchanges such as FTX and Mt. Gox as reasons why DEXs like BSX are becoming increasingly popular.

BSX addresses such concerns by way of a hybrid framework.

This comprises on-chain settlement to eliminate the risks associated with counterparty failures common among centralized platforms and an off-chain orderbook for speed and scalability.

The ability to retain full control over your own funds through self-custody solves a major potential issue and the transparency that comes along with it is a big step in the right direction.

Simply put, the funds that you trade with on BSX are yours and BSX does not ever take custody of them, swerving the potential threat of hacks.

A third thing that makes BSX stand out, are its comparatively low maker and taker fees.

As of the publication date, BSX’s maker and taker fees are:

- Maker: 0.005%

- Taker: 0.03%

This compares favorably to the 0.05% -0.10% fees commonly found on most decentralized exchanges.

These things alone, a deep, experienced team, a secure, non-custodial framework, and low overall fees, make BSX a DEX that that is better than most centralized exchanges.

Add in high liquidity of several billion dollars all-time and an API for large-volume traders that enables the use of external trading terminals without exposing private keys or relinquishing custody of your funds, and BSX makes a strong case for being the premier place to trade digital asset derivatives.

As a decentralized exchange, BSX is not just the future of derivatives trading, but all assets and it is a prime example of how each day, more and more people are transitioning from traditional financial institutions to DApps.

While platforms like Base provide developers with an ecosystem to tap into and build the apps of tomorrow that onboard users to enhanced experiences.

If you found this article insightful, you may also like Charting New Territory: How DePIN is Changing The Physical World With Digital Technology or The Tokenization of Real World Assets – Bigger Than The Internet?

If you would like more information on our thesis surrounding DeFi or other transformative technologies, please email info@cadenza.vc

One response to “Inside the Base Ecosystem: Bridging the Gap Between Traditional Finance and DeFi”

[…] If you found this insightful, you will also like Bridging Real-World Assets and Blockchain: Ostium Labs’ Bold Vision and Inside the Base Ecosystem: Bridging the Gap Between Traditional Finance and DeFi. […]

LikeLike