Blockchain technology is transforming capital markets beyond recognition.

New ways of trading, clearing, and settling a variety of assets have emerged for the first time in nearly 40 years. But challenges to accessing this new tech, and migrating assets on to it, still remain.

We reveal some solutions and one platform bringing assets onchain.

Inefficient And Non-Transparent

Until a few years ago, there was only one way to trade most kinds of financial assets – centralized exchanges.

It had been this way for the better part of four centuries. Ever since the Amsterdam Stock Exchange was created in 1611 to trade shares in the infamous Dutch East India Company.

Since that antiquated time some improvements have been made to asset trading.

Namely, the advent of clearing houses in the early 19th century to settle trades daily instead of weekly or monthly and the introduction of electronic trading in the 1980s, which made it possible to execute trades in mere seconds.

However, despite these necessary advancements, centralized exchanges still fall short of offering individual traders the best experience possible.

One of the most glaring problems is that exchanges still operate like a mom-and-pop retail business. This happens in spite of them possessing the resources of a Fortune 500 corporation.

For example, the largest stock exchange in the world, the New York Stock Exchange, operates from Monday through Friday 9:30 a.m. to 4:00 p.m. ET.

Then there are the indices, the Dow Jones Industrial Average and the S&P 500, which disproportionately affect the exchanges by acting as benchmarks for large institutional funds.

The problem is, such indices are “black boxes,” operated by committee, non-transparent in their stock selection and de-selection processes.

Still, irrespective of their shortcomings, traditional, centralized stock exchanges have maintained their positions as the only readily accessible places to purchase fractional ownership in certain assets…until now.

The Tokenization Takeover

From zero in 2017 to more than $3 billion today.

The market for tokenized assets has grown almost as fast as a meme coin shilled on social media.

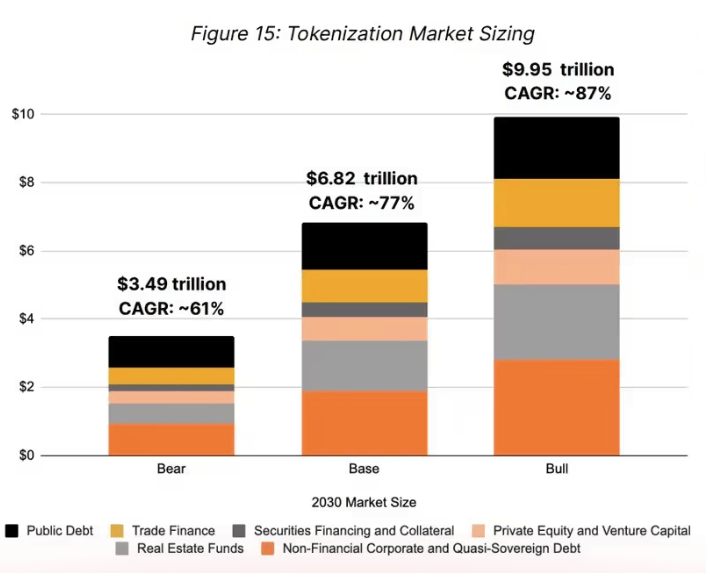

Some are calling for this to not just continue, but accelerate going forward:

Most of this projected growth is expected to come from the tokenization of traditional assets, namely currencies, stocks and bonds.

True to its name, tokenization entails issuing a unique and anonymous digital token that represents ownership in a real world asset (RWA).

To some this may seem like taking an extra step, but the benefits far outweigh the time and cost.

This is why countries like Hong Kong are already piloting a digital money ecosystem that includes an e-HKD digital currency and tokenized deposits.

Similarly, large Institutions such as JP Morgan Chase also see the writing on the wall and have jumped on the tokenization trend.

Its Kinexys (formerly Onyx) platform leverages the Avalanche Network to serve institutional clients across five continents and has processed more than $1.5 trillion worth of transactions since inception.

What they and myriads of others, from Goldman Sachs to the sovereign Republic of Germany have found out, is that tokenization’s transparency, speed, and most of all security, surpass that of traditional exchanges.

This increased efficiency also means an unparalleled opportunity that only comes around about once per century.

Innovators also grasp the magnitude of the tokenization opportunity and are working to hasten its takeover in more ways than one.

Decentralized Perpetuals

Non-custodial, derivative (perpetuals) trading platforms are a growing niche in the digital asset exchange market.

One where no clear leader has yet emerged.

Ostium Labs is hoping to become this by building a platform to trade RWA that addresses some of the major pain points currently plaguing the growing space.

One of Ostium’s maxims is “real assets, smarter infrastructure.”

The first way it lives up to it is through efficient pricing.

Ostium’s onchain exchange is open 24 hours a day, 7 days a week. Something that has yet to be matched by traditional exchanges, despite renewed efforts to make this a reality.

Since off-market hours present unique risks, Ostium has built-in mechanisms to minimize them. Besides being non-custodial, futures rollovers, advanced order types, and more are incorporated.

Such risk management tooling is a good start, but Ostium takes it a step further.

Its risk mitigation starts at the protocol level with real-time core metric tracking, which responds to fluctuating market conditions and trader behavior.

Moreover, the platform is also working on making its risk portal publicly accessible to all.

This completes one part of “smarter infrastructure.”

The other is much harder to pull off – a robust liquidity engine.

A Unique Architecture

Unlike legacy brokers, Ostium runs on a shared liquidity model.

This turns the traditional custodial, centralized liquidity model on its head.

For example, a forex or CFD trader with a typical brokerage account can only see prices and volume on their trading platform.

Logically, what follows is a lack of transparency, which could cause bad order fills. This is especially true for smaller, individual traders without access to expensive tools like Bloomberg’s FXGO.

On Ostium this is built in, with the platform’s shared liquidity and custom price oracle giving traders real price discovery and the ability to transfer assets seamlessly between different blockchains without the need for intermediaries.

Such features have set a standard for accessibility and flexibility that traders can expect, but how will Ostium grow to capture a share of the expanding perpetuals market?

This is where Ostium’s bold vision comes in.

Event-based trading is one way Ostium is innovating. Important macro events like the direction of interest rates, inflation, and even Presidential elections have been made tradeable.

Another way is bringing untapped real world assets, such as coffee futures, commodities, and infrastructure assets on-chain. All available to trade starting with as little as $10.

The Future of Asset Exchanges

As we write this, the only thing we can be sure of is that blockchain technology is bridging the gap between the digital and the real world.

Like all good things, this will take time to proliferate.

But its clear that onchain exchanges, like Ostium, provide a superior value proposition to traditional online brokers. Its only a matter of time until blockchain technology is either incorporated into traditional offerings or they are made obsolete.

Onchain is the future of trading.

If you found this insightful, you may also like Digital Assets for Everyone: How ETFs are Taking the Blockchain Mainstream or The Digital Asset Golden Age: Why Digital Assets Will Skyrocket Under A Trump Presidency.

If you would like more information on our thesis surrounding the blockchain or other transformative technologies, please email info@cadenza.vc

3 responses to “Bridging Real-World Assets and Blockchain: Ostium Labs’ Bold Vision”

[…] you found this insightful, you will also like Bridging Real-World Assets and Blockchain: Ostium Labs’ Bold Vision and Digital Assets for Everyone: How ETFs are Taking the Blockchain […]

LikeLike

[…] you found this insightful, you will also like Bridging Real-World Assets and Blockchain: Ostium Labs’ Bold Vision and Speed And Scalability: How Avalanche Is Powering the Next Wave of […]

LikeLike

[…] you found this insightful, you will also like Bridging Real-World Assets and Blockchain: Ostium Labs’ Bold Vision and Inside the Base Ecosystem: Bridging the Gap Between Traditional Finance and […]

LikeLike