Artificial Intelligence is growing more powerful by the day.

So far, its biggest innovation has been AI agents, but we are quickly moving beyond this to broader general intelligence.

One company is reshaping how it will be developed, scaled, and valued.

The Ultimate Goal

Artificial General Intelligence (AGI) or human-like intelligence has been described as the ultimate goal of AI.

Most researchers, developers, and others on the front line would agree with this assessment. However, where the rapture occurs is how to get there.

The traditional way would centralize data, algorithms, and processes onto a single server, and make it extremely difficult for new entrants to get a foot in the door, let alone challenge today’s incumbents.

This is the path we are currently on.

Until recently, the odds of a tangible alternative seemed longer than a new small business succeeding.

But that was before a powerful combination emerged that will take the power away from big tech and put it back in the hands of individuals.

Blockchain + AI = Bittensor

Similar to how Bitcoin brought fair, anti-fiat money to the masses, Bittensor is building a decentralized network of interconnected machine learning models.

What exactly is this?

In simple terms, Bittensor is a blockchain-based, open-source protocol enabling the development of artificial intelligence on a distributed ledger.

It’s a revolutionary idea that has only been around for the better part of two years now, but it’s one that has gotten traction for a few reasons.

First, there is the community Bittensor has built.

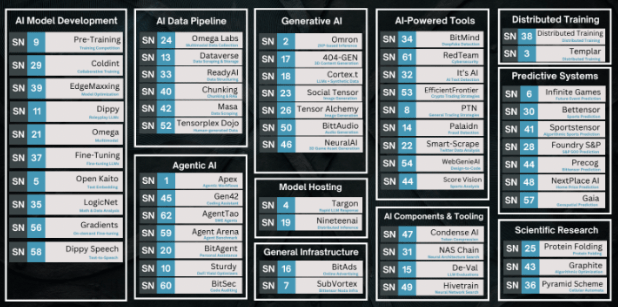

Currently, there are more than 70 subnets operating in the Bittensor ecosystem, all of which are dedicated to producing computational power, storage space, AI inference, data scraping, and more.

Second, Bittensor’s TAO token has incentivized miners and validators to actively participate in subnets. It’s worked, as TAO has become the 30th largest token by market cap exceeding $4.4 billion (May 2025), with thousands of holders.

TAO’s maximum supply is fixed at 21 million tokens with a regular four-year halving feature that has created an attractive value proposition for investors.

Finally, the enticing combination of blockchain with scalable AI has attracted other developers to the growing Bittensor ecosystem.

One of these is Omron, the world’s largest peer-to-peer Verified Intelligence network.

Omron incentivizes the creation of computational services by maintaining a 100% proof verification rate. This means that users can rely on computations to elevate their own projects, rather than any individual miner or validator.

However, this is just one subnet on Bittensor.

Another is the Masa Network, which has produced TAO Cat, Bittensor’s first self-improving AI agent.

Combining the blockchain and a proprietary AI algorithm, TAO Cat analyzes social media data in real-time , such as the hundreds of gigabytes generated on X everyday, powering the improvement of Bittensor AI.

As TAO Cat continues to improve, it holds the potential to become a truly intelligent AI or AGI agent.

While some projects are the future, others, such as Celium, are the present.

Computing resources are essential to long term AI’s development, as we have already highlighted, and Celium’s platform provides seamless access to GPU computing.

The demand for GPU units is so great, that Celium is on track to generate $50 million in revenue this year.

Now, one company is attempting to turn the entire Bittensor decentralized AI ecosystem into a tradable commodity.

The Entry Point to Decentralized AI

Founded on the same principles as Bittensor of accessibility, openness, and innovation, xTAO was established to provide investors with an entry point to decentralized AI.

The brainchild of Karia Samaroo, a former attorney turned entrepreneur. Karia’s last venture was WonderFi. A cryptocurrency exchange that went on to become Canada’s largest digital asset platform, and which ended up just getting acquired by Robinhood.

Before this, Karia cut his teeth serving as the General Counsel of First Block Capital. A regulated platform for financial services in the digital asset space dubbed the “Goldman Sachs of Crypto,” which was bought out by 3iQ in 2018.

Now, Karia is leveraging his firsthand experience in institutional finance to bring the latest technological innovations directly to the masses.

Backed with $10 million in investment capital, Karia’s bold vision is to turn his one-year-old project into the first publicly-traded company with direct exposure to Bittensor.

xTAO will take a big step towards this in the second half of 2025, when it is expected to list its shares on the Toronto Venture Exchange (TSXV), by completing a reverse merger transaction.

Taking a page out of the MicroStrategy (Nasdaq: MSTR) playbook, xTAO plans to maintain regular business operations as a Bittensor staker and validator, while using the capital raised to acquire TAO tokens.

Similar to MicroStrategy, its long-term growth will depend on the value of TAO, as the Bittensor token will serve as xTAO’s primary treasury reserve asset.

This presents several opportunities and challenges.

A Revolutionary Upgrade

Some say “timing is everything.”

In this instance, they may be right because xTAO’s timing to begin acquiring Bittensor TAO tokens couldn’t be better.

For starters, the price of TAO has declined by about 5%, alongside the rest of the cryptocurrency market, thus far this year. So now is a good time to accumulate.

We’re not calling a bottom, but several price catalysts are in place. From rising trading volume to bullish community sentiment, and even Grayscale launching a Bittensor TAO Trust for accredited investors.

However, the biggest opportunity, by far, comes from Bittensor’s most recent network upgrade.

At the beginning of the year, Bittensor introduced Dynamic TAO (dTAO).

This effectively established unique tokens (currencies) for each respective subnet, and liquidity pools for the same.

It stays true to the decentralization ethos and creates a self-balancing system where the most valuable AI markets (subnets) attract the most resources.

As the Bittensor network expands to support thousands of specialized AI markets, so too will its intrinsic value, and the market price of TAO.

Still, challenges persist.

Foremost among these is user onboarding.

Despite generative AI coming into the public consciousness in 2022, it remains a new technology for many. Add blockchain to the equation, and it is even more alien.

This will gradually change as AI seeps more and more into people’s work and day-to-day life, but it will take time.

Another challenge is security.

The perception among many is that decentralization means sacrificing some security when it comes to data privacy.

As the most secure technology in the world, the blockchain that underlies the Bittensor network addresses such concerns head-on. However, minds don’t change overnight, and adoption among institutional users won’t come easy.

In a world dominated by closed AI, xTAO is building an open alternative.

Straddling the worlds of AI, Web3, blockchain, and crypto based on the projects now flourishing on Bittensor, xTAO’s potential, given its structure as a public company, is to make these emerging markets more visible and scalable.

It could also make an attractive investment, based on an appreciating net asset value, and its low operating cost.

Autonomous AI economies aren’t quite here yet, but now is the time to pay attention to xTAO.

If you found this insightful, you will also like Why Everyone’s Talking About Decentralized AI and Bridging Real-World Assets and Blockchain: Ostium Labs’ Bold Vision.

If you would like more information on our thesis surrounding Decentralized AI or other transformative technologies, please email info@cadenza.vc