Ownership of assets hasn’t always meant control over those assets.

This is especially true when it comes to digital assets, with approximately 7 out of every 10 owners holding their assets in custodial wallets.

However, there is a simpler, better, and more secure way to store your digital assets that gives you absolute control over them.

We’re revealing what it is and how we got here.

Hot Wallets Nearly Killed Bitcoin

On June 20th, 2011 an individual hacker stole 2,000 Bitcoin (BTC) from the now infamous MtGox exchange.

The impact and fallout were monumental for two reasons.

First, the price of Bitcoin went from $32 down to $0.01 in a matter of minutes!

The first flash crash in BTC history caused widespread uncertainty and panic, with many thinking the BTC blockchain may have been accessed.

It nearly ended the nascent cryptocurrency before it ever really got started.

Second, it brought much needed attention to how digital assets are stored and managed.

Technically, the very first crypto wallet was a paper print out.

See, wallets don’t physically store digital assets. The blockchain does this and private wallet keys are used to access them.

Back in those early days, private keys were basic paper printouts or software wallets like Bitcoin Core.

These were typically installed on PCs, required constant back ups to avoid viruses, and gave users full control over their private keys.

Despite security measures such as two-factor authentication (2FA), hackers still routinely got hold of private keys kept on unencrypted drives and wreaked havoc.

Active traders who dabbled in swapping BTC for Litecoin or Namecoin during this time didn’t have many alternatives for managing their coins…until mobile wallets came along and changed everything.

The Mobile Wallet Revolution

Initially introduced in the wake of the MtGox hack, the open-source Electrum wallet was the first to enable users to manage digital assets on a mobile device.

At the time, this was nothing short of revolutionary and it was also an upgrade in terms of security.

Besides being a true cold wallet, meaning private keys were kept on a platform not connected to the Internet. Electrum also supported biometric identification and secret phrase recovery.

The rise in mobile wallet popularity also coincided with another significant development in crypto security – the emergence of multi-signature (multisig) solutions.

This marked the beginning of digital assets’ evolution from a passionate, but small niche, into a legitimate asset class.

Vaults And Safes

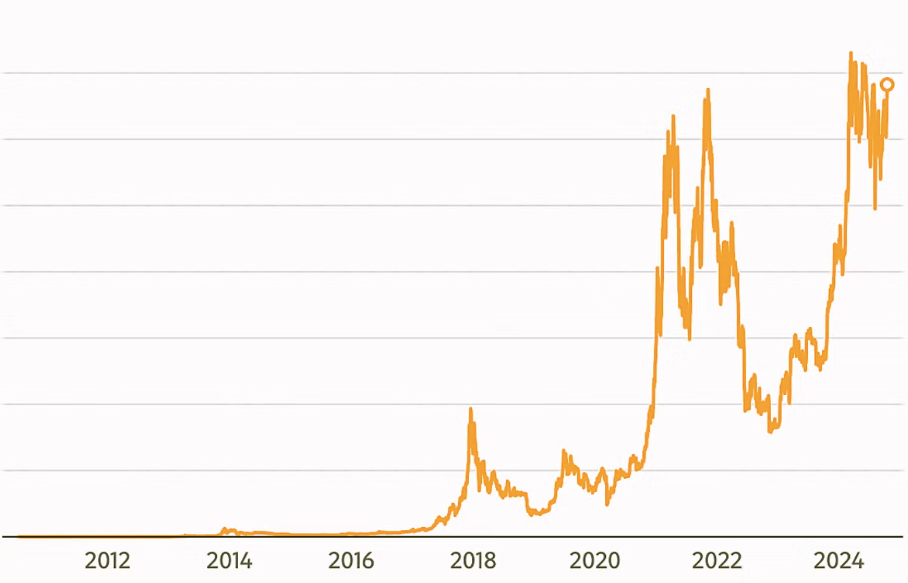

From $34 million to $2 trillion.

These figures represent Bitcoin’s market cap over the past decade plus.

It is now the world’s 7th most valuable asset when measured by market cap and there are now over one million retail and institutional investors holding 1 BTC or more.

Such wealth demands enterprise-grade security and safekeeping.

Multisignature (multisig) has emerged as one of the most secure methods to manage digital assets.

This is because it is the digital equivalent of a bank vault or safe.

For example, a traditional digital asset wallet only requires a single set of private keys to perform actions like sending and receiving funds.

However, similarly to how a modern bank vault incorporates multi-tier security in the form of double-doors, biometric scanners, and private keys. A multisig wallet adds a layer of security by requiring multiple private keys to sign off on a transaction.

This aims to solve multiple challenges faced by digital asset owners today.

The first is the very real possibility of losing a set of private keys.

Until now, with few exceptions, losing a set of private keys meant losing access to your funds permanently. Just ask James Howells who lost almost $800 million in BTC by throwing out his old computer hard drive.

Multisig solves this with its multi-key architecture.

Another problem that a multisig wallet does away with is single corporate key-holder authorization.

By requiring multiple sign-offs to complete a single transaction, the risk of unauthorized activity is significantly reduced.

One digital asset storage solution takes the multisig concept and raises it to another level.

10x The Security

Founded in 2016 and publicly launched two years later, Casa was started to help individuals and enterprises take control of their digital assets, forever.

In many ways, it was before its time.

Although Casa was not the first to market with a multisig wallet, it was one of the first to offer a multi-layered self-custody security platform.

Simply put, self-custody minimizes third-party risk.

This is no imaginary boogeyman.

In 2024 alone, more than $2.2 billion was stolen from digital asset exchanges. A 21% jump from the prior year.

Stories abound online about hackers employing increasingly advanced techniques like cross-chain exploits that is making attacks harder to detect.

Its a stark reminder that exploits and vulnerabilities not only exist, but are on the rise.

Casa’s multi-key vault enables the creation of a self-custodial wallet with cold storage, that keeps your private keys offline.

This is 10x more secure than the average hardware wallet.

But Casa doesn’t stop there.

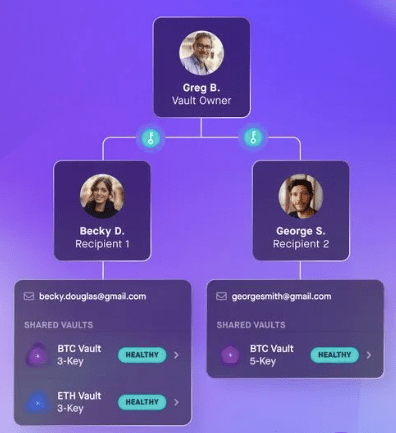

Besides a multisig wallet that maintains access to your funds even if one of your keys is lost or stolen, Casa further differentiates itself with digital asset inheritance.

By allowing users to designate recipients to their vault and adhering to a stringent multi-step process. An inheritance plan takes all the stress and complexity out of digital wealth transfers.

Within a month of launching, more than 200 users set up an inheritance plan and it has driven revenue growth for Casa ever since.

Casa also helps more institutional investors, including small and mid-size businesses, control their digital asset holdings than perhaps any other self-custody security platform.

Over the long term, this positions Casa to become a full-service security platform, beyond crypto, as its switching cost continues to increase, and it becomes an indispensable part of user’s lives.

It’s estimated that around 20% of all Bitcoin has been lost due to user errors.

Multi-chain, multi-key self-custody solves this while also fulfilling two of digital assets’ long-held promises:

- No intermediaries

- Full ownership

However, complexity and a lack of user-friendly interfaces have kept self-custody solutions from fully being adopted.

As consumer interfaces become more intuitive and security features grow more sophisticated. An ever larger number of digital asset owners will take full ownership of their assets.

If you found this insightful, you will also like Guardians of the Digital Galaxy: How AI is Changing Cybersecurity and Digital Gold Rush: How Digital Assets Are Ushering In A New Era of Financial Freedom in Latin America.

If you would like more information on our thesis surrounding Cybersecurity or other transformative technologies, please email info@cadenza.vc

One response to “The Ultimate Safe Haven: Why Self-Custody is the Future”

[…] you found this insightful, you will also like The Ultimate Safe Haven: Why Self-Custody is the Future and Web3 Meets Wall Street: Kraken’s Bold Push into Tokenized […]

LikeLike