Despite market volatility, economic uncertainty, and a less-than-favorable funding environment, 61 deals for an aggregate value of $2.2 billion were completed in the digital asset space so far this year. A record.

This consolidation is reshaping the industry, with deep implications for risk, returns, and strategies across the entire ecosystem.

The First Stage

Digital assets have matured before our eyes.

It wasn’t that long ago that a few programmers and early adopters were talking about a theoretical open-source digital cash system, and pizzas were being bought for 10,000 Bitcoins.

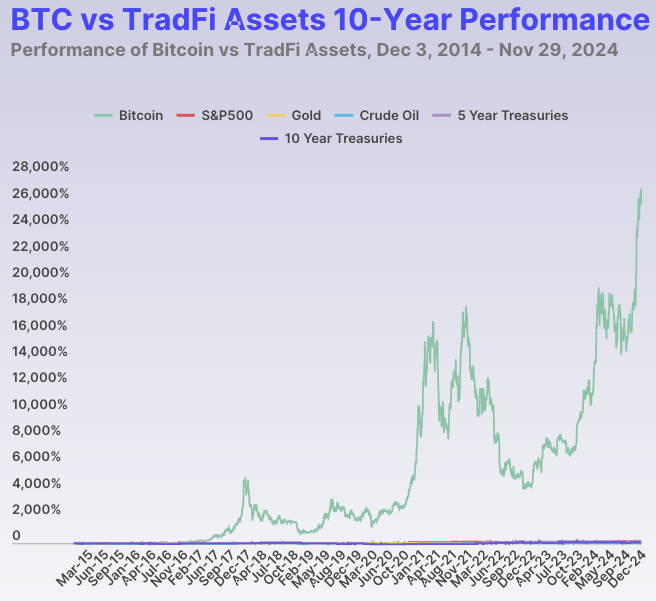

Since those early days, the first stage of digital assets can best be described as “explosive.”

No other asset, digital or otherwise, has come close to matching Bitcoin’s performance:

Altcoins such as Ethereum (ETH) have also emerged. These have become multi-billion-dollar assets in their own right and introduced some of the first blockchain applications with major crossover appeal, like smart contracts.

On the back of this early success, more projects have been launched.

Some have raised billions right out of the gate, while others have become market leaders. Others still, were victims of their own success.

Still, despite some normal cyclical declines. Digital assets and the blockchain technology powering them are solving some of our toughest problems, and have become core pillars of investment portfolios.

From faster, more secure financial transactions to platforms designed to host decentralized, scalable applications, and the democratization of machine learning, which is mission-critical to the development of artificial intelligence.

Innovation, profits, and above-average growth have rightfully attracted a lot of attention and capital. This has hastened digital assets’ second stage.

Strategic Consolidation

Today, there are more than 17,000 digital tokens in existence, a number that is growing by the day.

However, only around 2% of these are backed by tangible projects and listed on major exchanges. This means several hundred established and emerging players in fast-growing verticals such as infrastructure, DeFi, Web3 gaming, and beyond.

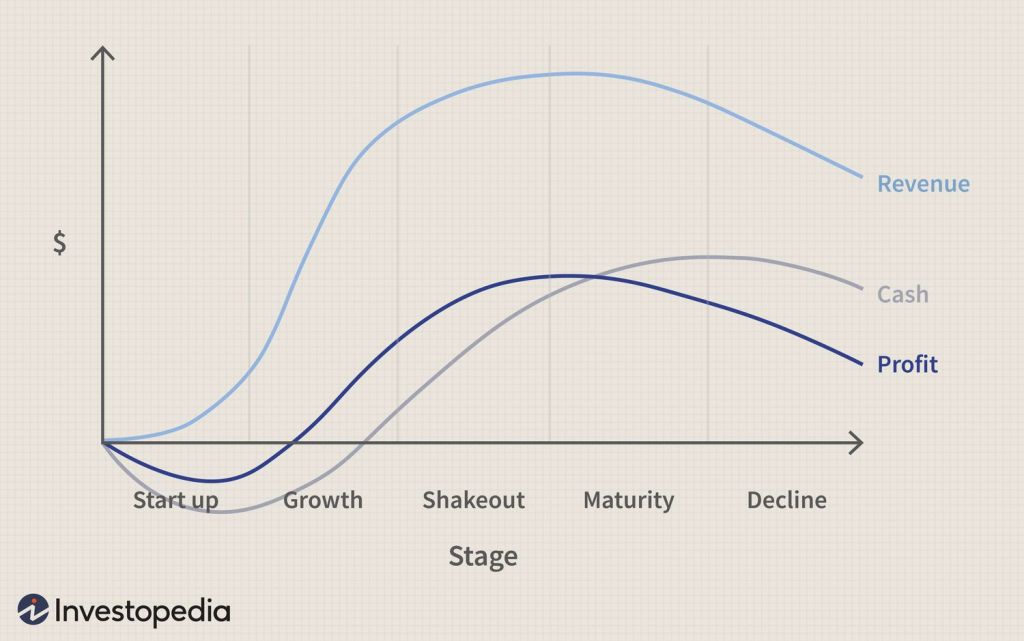

If you’ve been around for more than one market cycle, you already know what happens to a market after its first stage. It usually looks like this:

Now, digital assets are still very much in the second stage (growth), but it has begun to shift from explosive early-stage growth to strategic consolidation.

The proof is all around us.

Not only was digital assets’ first quarter M&A the highest on record, but this momentum has continued into the second quarter.

One of the best examples of this is Ripple, a leading provider of digital asset infrastructure for financial institutions, which recently announced that it is acquiring prime broker Hidden Road for $1.25 billion.

In the same breath, an even bigger deal was just announced.

Coinbase’s acquisition of digital asset derivatives exchange Deribit for a whopping $2.9 billion in cash and securities.

These two acquisitions alone, worth a combined $4.1 billion, just set a new benchmark for digital asset deals.

This comes as no surprise. We were talking about how derivatives were shaping the digital token market last year, and saying that a more friendly regulatory regime would be the catalyst for digital assets and it’s derivatives.

That time has now arrived, and so far, it is not disappointing.

Finance FTW

The primary beneficiary thus far has been finance, with a total 2025 deal value more than double the next closest sector – infrastructure.

A primary driver of this strategic consolidation has been a blurring of the lines between digital assets and traditional financial services (TradFi), most unusually.

Typically, when young upstart businesses break out and start experiencing explosive growth, they are gobbled up by more established institutions like a shark devouring tuna.

There has been some of this, with Robinhood acquiring a pair of international digital asset exchanges in Luxembourg-based Bitstamp and Canada’s WonderFi in separate deals. Handing the US-based trading platform more than 50 global digital asset licenses.

However, the deals closing now are more like Black Swallower fish, which consume other fish larger than themselves.

One of the best examples of this is Kraken acquiring futures trading platform NinjaTrader.

No doubt, there will be more such deals as the digital asset regulatory picture becomes clearer, and compliance and licensing become all-important.

For entrepreneurs and investors alike, this evolving landscape has major implications.

A New Paradigm

Regulatory pressure, complicated IPO paths, and token fatigue have turned the traditional digital investment asset thesis on its head.

Over the last 15 years or so, since a16 and Union Square Ventures pioneered investing in blockchain-related projects, the emphasis has been on early-stage moonshots and Initial Coin Offerings (ICOs) as the primary return path.

This model has worked beautifully.

More than $130 billion has been invested in digital assets, creating $3.5 trillion in value, and we’re still at the growth stage.

According to some, this has even outpaced the Internet at the same point in

its development.

Now, with funded businesses maturing and strategic M&A on the rise, a different model is needed to respond to a new set of risks and challenges.

Acquirable Assets

Funds are shifting away from businesses with 100x growth potential and into verticals that make attractive add-on acquisitions.

Moonshots won’t completely go away, as they are far too lucrative and fun. But the number of deals in more practical areas, such as payments infrastructure, wallets, and compliance tools, will increase.

More Equity, Less Tokens

Faster exits also mean different deal structuring at the seed or first round stage.

Since the majority of M&A transactions take the form of either stock sales or mergers, early-stage investors are adjusting accordingly and gearing their exposure more toward equity.

This also has the added effect of broadening the acquisition appeal of portfolio companies.

A New Era of Value

Digital asset M&A won’t be a big tidal wave that fundamentally changes the industry, at least not yet.

However, a steady acceleration of deal activity over the next few years, bridging the digital and fiat worlds, means a necessary adjustment period.

Early-stage venture investing is adapting and evolving, too. Moving beyond token bets into equity in acquirable assets, or assets that go on to acquire others, as we have already seen happen.

The long-term vision of digital assets becoming as commonly used for payment and exchange as fiat currencies are today remains unchanged. The only thing shifting is how we get there, as a new era of value creation begins.

If you found this insightful, you will also like Bridging Real-World Assets and Blockchain: Ostium Labs’ Bold Vision and Speed And Scalability: How Avalanche Is Powering the Next Wave of DeFi.

If you would like more information on our thesis surrounding digital assets or other transformative technologies, please email info@cadenza.vc