The next big decentralized finance breakthrough won’t come just from AI automation, tokenized assets, or yield farms.

Instead, what will endure is structurally sound infrastructure that entire industries such as decentralized exchanges and smart contracts are built on.

That’s what Ostium Labs is building.

The Problems No One Wants to Admit

Decentralized Finance (DeFi) is still a very new concept, despite its major traction.

For example, blockchain technology didn’t exist 20 years ago and peer-to-peer lending wasn’t a thing until the mid-2000s.

They were created as solutions to the lack of transparency, accessibility, and high cost of traditional financial systems. But in the process, new challenges to overcome have cropped up.

Everyone, including the most pragmatic developer, would admit that user experience matters.

Many DeFi applications leave a lot to be desired in terms of UX.

From cross-protocol inoperability to technically complex digital wallet application set ups, and then there’s liquidity fragmentation.

There are currently more than seven million active liquidity pools across the DeFi ecosystem.

This fragmentation often dilutes liquidity, making “open finance” ironically inaccessible.

DeFi needs is better infrastructure.

A System Designed for Reliability and Trust

Real decentralization is impossible without real data primitives.

In plain English, this means decentralization won’t happen with current infrastructure.

San Francisco-based Ostium Labs is the gateway to more accessible and efficient markets.

Originally founded as a perpetual swaps exchange for real-world assets in 2022 by a pair of Harvard graduates with diverse backgrounds in neuroscience, physics, and ballet.

The platform has proven that there is a large and growing market for trading traditional assets on-chain.

Since inception, Ostium has steadily grown to more than $20 billion in annual trading volume and 300k+ executed trades.

This growth, along with Ostium’s upward trajectory has earned the decentralized exchange a healthy $20 million in Series A funding, with Cadenza participating in it’s initial seed round.

Entrepreneurs and investors have long sought to seamlessly fuse traditional markets with blockchain technology and Ostium’s underlying architecture is turning this vision into reality.

The Ostium Protocol is better infrastructure, not just another chain.

At its core, the protocol facilitates exchange, provides liquidity, and enables real-time asset price discovery.

It accomplishes this through several mechanisms.

Shared Liquidity Layer

First, Ostium does away with the traditional order book.

It replaces it with a shared liquidity layer that is engineered to both enhance efficiency and reduce trading costs.

This is achieved through automated price adjustments based on the supply and demand of any given tradable asset, ensuring uninterrupted liquidity.

Oracle-Based Pricing

Unlike Centralized Exchanges (CEXs), which rely heavily on internal pricing mechanisms, Ostium’s oracle-based pricing is a decidedly decentralized price discovery mechanism.

Their custom-built oracle system refutes the “one chain to rule them all” pipe dream by pulling price data from the open market, which helps prevent manipulation and ensures maximum accuracy.

Self Custody

Finally, in light of CEXs experiencing billions of dollars in custodial losses over the last few years alone. Individual and institutional investors have begun rethinking where and how their funds are held.

Ostium addresses this issue head on by enabling all investors to retain full self-custody over their funds at all times, rather than having to transfer to a centralized depository.

Overall, Ostium’s architecture is a radical deviation from the norm, designed to succeed where others break down.

It’s a return to fundamentals that is taking the platform beyond decentralized exchange.

The Missing DeFi Layer

Ostium has carved out a well-defined niche for itself in perpetual (perps) trading of real-world assets like stocks, commodities, and precious metals.

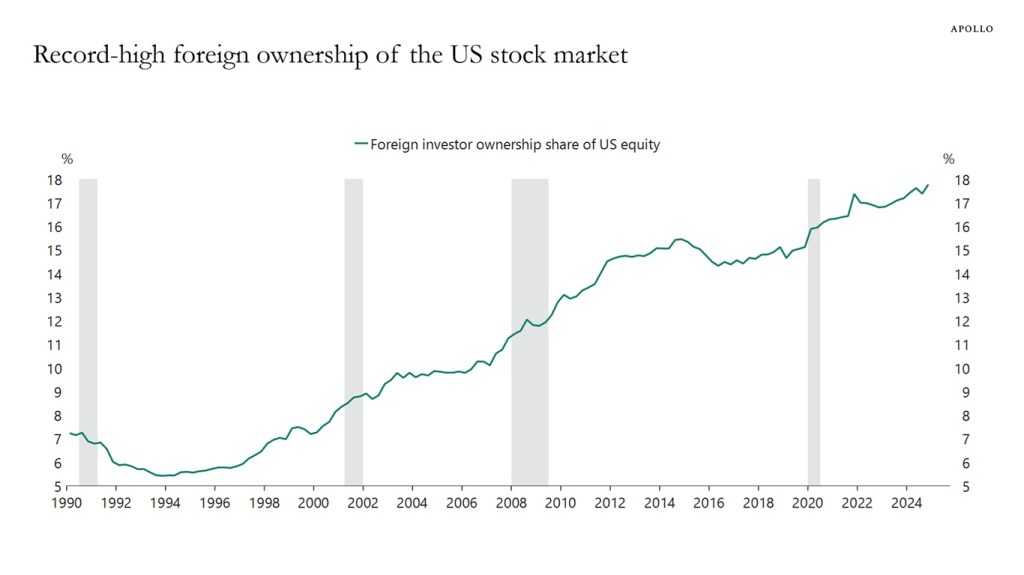

The logical next step is to continue winning market share by targeting less-obvious customer segments, such as offshore investors who want to own U.S. assets.

This represents a massive multi-trillion market that decentralized exchanges have barely begun to scratch the surface of.

However, beyond this, there is an even bigger opportunity.

The future of not just exchanges, but where decentralized finance is going depends on data infrastructure.

By nature, peer-to-peer systems are more transparent and efficient than their centralized counterparts. But their immutability and transparency haven’t been enough to make up for the stability and scalability concerns.

The Ostium Protocol’s three pillar approach is finally bringing it all together.

It recognizes that “any high-speed DEX needs off-chain infrastructure to support it.”

This starts with the Protocol’s off-chain infrastructure.

Ostium’s direct partnerships with Stork and Chainlink ensure real-time, verifiable price data for every listed asset.

The Trading Engine as the second pillar executes trades in milliseconds, making for a seamless user experience rivaling that of modern trading apps like Robinhood.

Thirdly, we have already touched on the Shared Liquidity Layer that replaces a single order book with liquidity drawn from multiple blockchains.

Ostium’s approach has the potential to quietly become the infrastructure that powers hundreds of protocols.

The combination of true interoperability and a stable, scalable engine that doesn’t sacrifice safety and efficiency makes the Ostium Protocol unusually valuable.

The Future Belongs to Infrastructure Builders

DeFi innovation will come from infrastructure, not speculation.

The decentralized finance space is becoming increasingly competitive, with both startups and established financial houses like JP Morgan and Standard Chartered getting into the fray.

However, amidst all the tokenized asset and digital trading platforms that have been created, Ostium’s architecture is one of the best for bridging the divide between traditional markets and the blockchain.

If financial history has taught us anything, it’s that what ultimately ends up surviving isn’t necessarily the loudest, but what is the most structurally sound.

If you found this insightful, you will also like The Ultimate Safe Haven: Why Self-Custody is the Future and Web3 Meets Wall Street: Kraken’s Bold Push into Tokenized Securities.

If you would like more information on our thesis surrounding decentralized finance or other transformative technologies, please email info@cadenza.vc