Bridging traditional finance and digital assets on a global scale.

This is Kraken’s long-term vision and it just took a major step toward realizing it.

A New Era

The second longest operating digital asset exchange has had a year that is on par with any high-flying stock.

It’s trading volume broke through $100 billion per quarter, revenue is up 114% year-over-year through Q3, and it is now a global exchange spanning North America, Europe, Asia, and Latin America.

Looking at all this, it’s a bit surprising that Kraken’s valuation didn’t increase by more than 35% between the third and fourth quarter.

The appreciation came on the heels of a dual-tranche $800 million investment, highlighted by Citadel Securities contributing $200 million of the total, with Cadenza also participating in the initial tranche.

The funding round raised the value of the digital asset platform to a massive $20 billion.

To top it all off, Kraken has also formally filed for an initial public offering (IPO).

Robust growth and fresh capital are ushering in a new era of expansion, but the big question now is…what comes next?

Kraken’s Product Roadmap

Since it’s inception in 2011, Kraken only raised $27 million in outside capital, until recently.

It has bidded it’s time, prepared for legal clarity by building the necessary security and trading infrastructure, and now it is finally ready to fulfill it’s mission – create a platform where anyone can trade any asset, anytime, anywhere.

This starts by strengthening it’s core capabilities.

Besides security, ease of access to funds is one of the primary concerns for traders when selecting an exchange.

To help with this, Kraken recently introduced an Automated Customer Account Transfer Service (ACATS).

This let’s users transfer their stock and ETF holdings from existing brokers to Kraken without having to liquidate any of their assets.

For anyone that has ever had to deal with days of waiting for new accounts to be funded and complete endless forms to do so, this is a welcome feature.

Kraken has also enhanced its trading suite.

Digital assets have long operated on a 24/7 clock, but traditional assets have been stuck on market hours.

Despite proposals to change this, nothing has yet been made official.

Kraken is doing its part by making U.S. equity trading available 24 hours per day, Monday to Friday, for all Kraken Pro users.

Simplifying onboarding and improving liquidity is a good start, however, it is not what will move the needle going forward.

Two things will.

Global Expansion

As we write this, Kraken is available in over 190 countries.

So, apart from adding currently restricted markets, it doesn’t get anymore global than this.

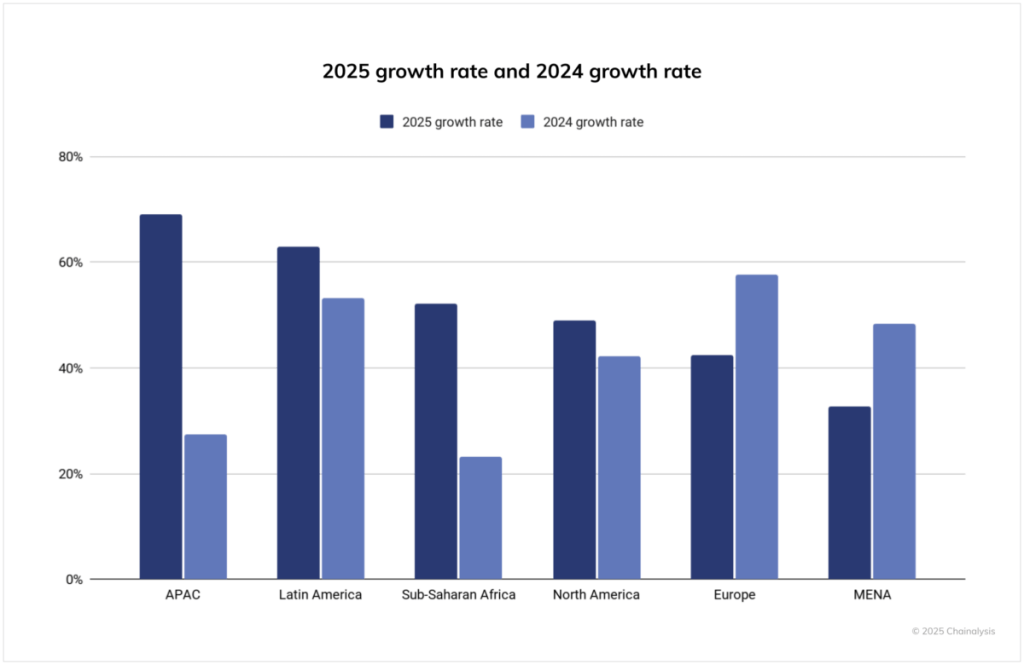

Where the opportunity lies is in bolstering and broadening its offering across Latin America, Asia Pacific, and EMEA.

Each region is experiencing rapid digital asset adoption and remains largely fragmented or dominated by local or regional exchanges.

Kraken is a top 3 global exchange by trading share, but in some particularly active, emerging markets, such as Argentina and Vietnam, it ranks outside of the top 5.

This is where it is leveraging its new funding to secure local securities brokerage licenses and partnerships.

In Argentina, this happened already, with Kraken formally registering as a Virtual Asset Service Provider (VASP) with Argentina’s Comisión Nacional de Valores (CNV).

The global exchange has also added native currency rails, eliminating the need to convert funds into USD before buying digital assets.

Fortunately, Kraken has a solid blueprint to follow…

Differentiate with a compliance and infrastructure-first approach, win market share with user-friendly features, and eventually expand by adding equities, futures, and other in-demand products.

Replicate this enough times and Kraken can build a durable, regional competitive advantage in each market it enters.

Another driver of growth is prime brokerage.

Institutional Services

July 2025 was a turning point.

The GENIUS Act wasn’t just stablecoin legislation.

It set the stage for digital asset regulation in the world’s largest financial market and signaled to institutional investors that a major new asset class was for the taking.

Cross-referencing CoinShares’ post-July weekly data and a16z crypto reports, more than $50 billion of institutional capital has flowed into digital assets since the act was signed into law.

Kraken, along with a few competitor exchanges, such as Binance and Coinbase, were perfectly positioned to capitalize on this.

By having the infrastructure stack in terms of custody, clearing, settlement, market data, and wallet services, not to mention the liquidity. The top digital asset exchanges are the logical landing spot for the capital of hedge funds, asset managers, and corporates.

Strategic investors like Citadel understand this and the synergy is mutual.

As one of the largest market makers, Citadel provides Kraken with unique insight into building a differentiated prime brokerage service.

At the same time, Citadel is getting an equity stake in a leading global digital asset exchange.

The Road to 2030

The road ahead is clear and conditions favor Kraken, but some speedbumps still remain.

One of the single biggest pitfalls is security.

Besides some notable fraudulent operators, centralized exchanges from Mt. Gox to Cryptopia, and DMM have fallen due to security breaches.

Fortunately, Kraken has never lost customer funds and goes so far as to offer no phone/SMS account recovery to ensure accounts always remain in owner hands.

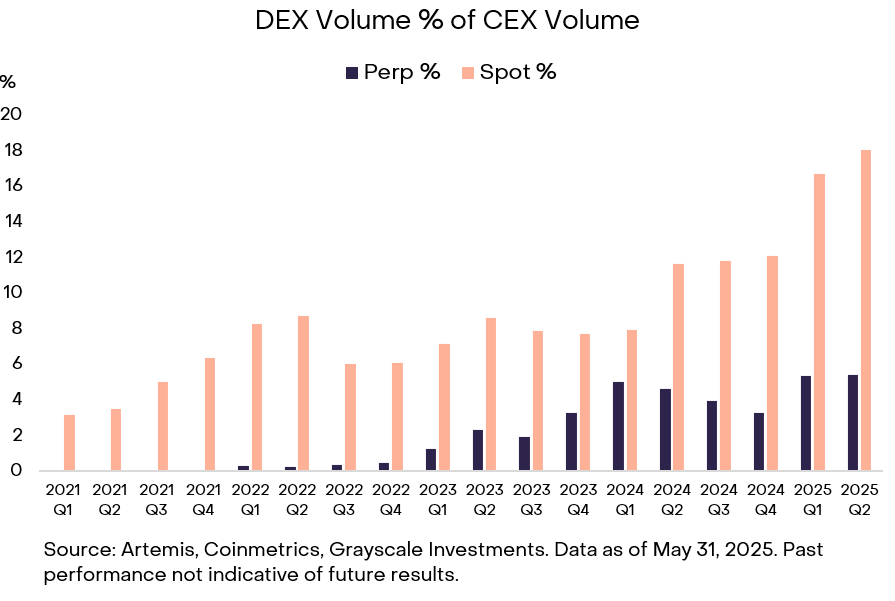

However, the bigger concern is competition from Decentralized Exchanges (DEXs).

Given the lack of counterparty risk and instant transaction speed, these have captured more than 8% of total digital asset trading volume and growing:

This is where Kraken’s vision of bridging traditional finance with digital assets matters.

By introducing equities, futures, derivatives, and lending products on an international scale, it caters to a higher-margin institutional clientele that aren’t the primary market of DEXs.

No matter what lense or angle it is viewed from, Kraken’s raise and expansion marks a key turning point for Fintech.

It signals that blockchain infrastructure is growing in importance, as it will underpin trading and financial markets in the future.

It also let’s us know that all assets, irrespective of where they trade now, will be digital.

If you found this insightful, you will also like The Stablecoin Breakout: Why Circle’s IPO is a Game-Changer and The Next Industrial Revolution: Why Infrastructure Spending Is the New Trillion-Dollar Boom

If you would like more information on our thesis surrounding blockchain or other transformative technologies, please email info@cadenza.vc